FAQ

Click the + to expand a section

New Business / Underwriting

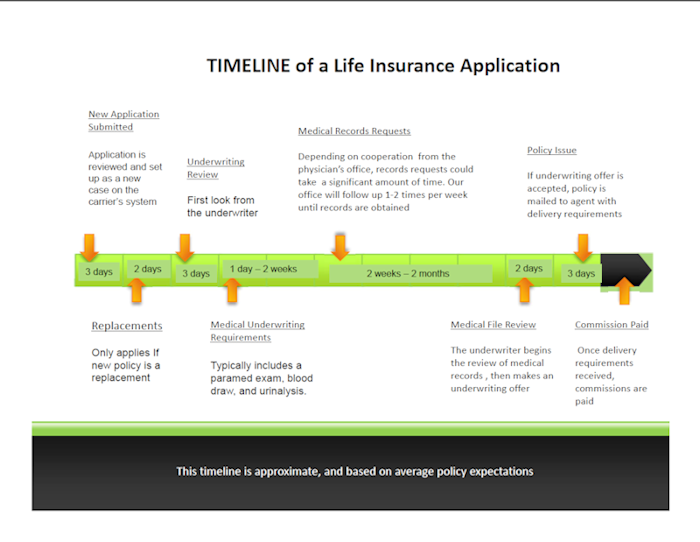

- How long does it take for a life insurance application to be underwritten and issued?

- There are many steps involved in the process from application submission until policy issue. Please click below for a timeline of the average life insurance case:

Licensing / Contracting

Please note the important FAQs below. Appropriate licenses, appointments, and education requirements can vary from state to state.

- Do I have to be appointed with the insurance carrier before I take an application?

- There are 43 states/jurisdictions that are Just in Time (JIT) states, meaning that an agent is not required to have a state appointment before soliciting applications for insurance, but---

- These 43 states/jurisdictions regulate WHEN a producer can sign an application with a client in relation to the appointment effective date:

- AL, AK, CA, DC, IA, KS, MD, MO, ND, OH, TX, VA allow for solicitation of business within 30 days prior to the appointment effective date.

- AR, CT, DE, GA, HI, ID, KY, ME, MA, MI, MN, MS, NC, NE, NH, NJ, NM, NV, NY, OK, OR, PR, SC, SD, TN, UT, VT, WA,WV, WI, WY allow for solicitation of business within 15 days prior to the appointment effective date.

- AZ, CO, IL, IN, MO, RI do not process appointments. A valid license is required to represent the insurer.

- Do some states require pre-appointment BEFORE soliciting applications for insurance?

- Yes-- there are 4 states/jurisdictions that require pre-appointment: PA, MT, GU, VI

- Do I have to be appointed to sell in my client’s resident state?

- AK, WV, PR & VI require the writing producer to be licensed in the client’s (policy owner’s) resident state.

- Am I required to have health authority on my state insurance license in order to sell Long Term Care (LTC) or Disability Insurance (DI)?

- Yes, in all states.

- Am I required to have health authority on my state insurance license in order to sell LTC riders attached to life insurance policies?

- Yes, in all states, EXCEPT New York

- Am I required to complete additional LTC certification in order to sell traditional LTC or LTC riders attached to life insurance policies?

- Yes, in most states EXCEPT New York

- Any agent selling permanent life insurance must be current with their anti-money laundering (AML) training. If you do not have an AML provider, you can access the training at http://aml.limra.com

- All agents must be covered by an Errors & Omissions (E&O) insurance policy

- If you have additional questions, please contact Randy Bratton at (901) 399-0250

- How do I determine how much commission I make on a sale?

- Your commission payout is determined by your compensation agreement with your broker/dealer

- Is the commission rate the same, regardless of the insurance product that I sell?

- No—the commission rate is determined by the specific insurance product that is sold.

- Is the commission rate the same, regardless of where the product is sold?

- No—the commission rates for products sold in New York state are different than those sold in the other 49 states.

- When will I receive my commissions?

- Each carrier has its own commission cycle, but most carriers pay once weekly. Commissions are generated each time a premium is applied.

Commissions

©2012 Ken Prevett | Web Design by Stan Vickers

Layout Based on: Fluid 960 Grid System, created by Stephen Bau, based on the 960 Grid System by Nathan Smith . Released under the GPL / MIT Licenses.

Image Credits: Image: Ambro / FreeDigitalPhotos.net | Image: photostock / FreeDigitalPhotos.net